When it’s payday, it’s always a good feeling, but it’s also a reminder to send money back home. It’s important to have some best practices in place for sending money back home, to keep an eye on your finances. Make sure you don’t forget your do’s & don’ts.

Best Practices 🙂

| Do’s | Don’ts |

| Use Reputable Money Transfer Services | Don’t send cash through mail. |

| Monitor Exchange Rates | Don’t ignore exchange rate margins. |

| Verify Recipient Information | Don’t overlooked hidden charges. |

| Understand the Fees | Don’t transfer large sums without planning. |

| Track Your Transfer | Don’t use public wi-fi for transactions. |

| Consider Transfer Speed | Don’t rush the process. |

Do’s

Use Reputable Money Transfer Services

20 years back, we used to send money through remittance shops, but nowadays, there are plenty of online money transfer options available. Here are some of the services you can use.

Money Transfer Services:

Money Transfer Services (Philippines)

Monitor Exchange Rates

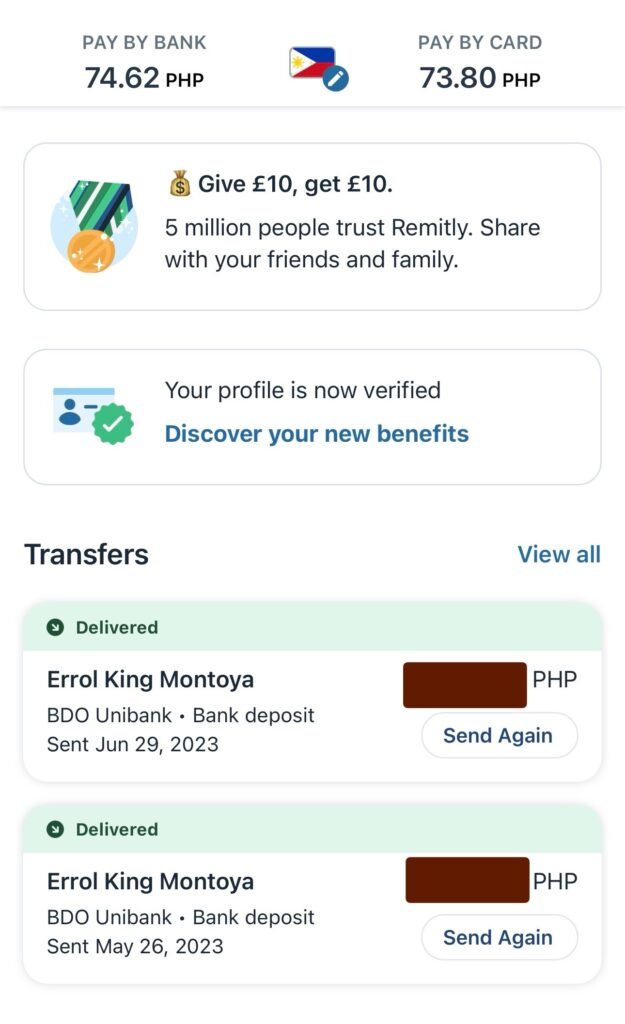

I usually use Remitly or BC Remit when I’m sending money back home. Before I go ahead with the transfer, I always check which one has the higher exchange rate. It’s important to keep an eye on these rates because they can change even after just a few seconds.

Verify Recipient Information

When you use a money transfer service for the first time, they’ll ask for your info and the recipient’s details. Fill in everything carefully, like names, contact numbers, and bank info, and double-check before hitting send.

If you often send money to the same person, their details will be saved, so you only have to fill out a new form for a new recipient.

Understand the Fees

Be aware of all the fees associated with the transfer to avoid unexpected costs. Most money transfer services do not have fees because they compete with the exchange rate. However, if you are using bank-to-bank transfer, there will definitely be a transfer fee, so you need to check on that.

Track your Transactions

Even though most money transfers happen quickly nowadays, there are times when it might take longer. This could be because of app maintenance or if you’re doing a bank-to-bank transfer, depending on your bank. Sometimes it could take a few days, so it’s a good idea to turn on notifications to keep track of your transaction.

Consider Transfer Speed

Make sure to pick a service that gives you a good balance between cost and speed. You never know when unexpected things might happen back home, and you might need to send money in a hurry.

Don’ts

Don’t send cash through mail.

Don’t bother with sending money through the mail – it’s risky and takes forever. Use money transfer services instead to speed things up.

Don’t ignore exchange rate margins.

Just a quick reminder to keep an eye on the exchange rate, even if it’s just a penny or a cent. When converted to your own currency, it could make a bigger difference than you realize.

Don’t overlooked hidden charges.

Most transfers don’t have any upfront fees, but the charges can vary based on the amount you’re sending and there might be hidden fees you need to watch out for. Some banks offer same-day transfers for an extra fee to speed up the process.

Don’t transfer large sums without planning.

If you’re sending a lot of money, make sure to think about how and when to send it. Consider how far your money needs to go, whether it’s a little or a lot, and also factor in any fees.

Don’t use public wi-fi for transactions.

So, imagine you’re strolling through the mall when you suddenly get a text from a family member asking for some cash. Would you send it right away? Well, it really depends on the situation, right? But if you decide to send it, just make sure you’re not using any public Wi-Fi. Those connections can be sketchy, and it’s easier for hackers to get your personal info. Just a heads up to stay safe!

Don’t rush the process.

Make sure to take your time and fill out the information carefully to avoid any delays with the money transfer. Always double-check before hitting that send button, because we’re sending money, not just a regular message.

Some folks send money home for allowances, while others do it for vacation funds. But whatever your reasons, just remember to follow the do’s and don’ts for the best practice when sending money back home.